Understanding MICs

Mortgage Investment Corporations (MICs) are pooled funds that invest in private mortgages on behalf of shareholders. They are one of the easiest ways for Canadian Investors to gain direct exposure to the private mortgage market.

Instead of a mutual fund or ETF that holds a portfolio of stocks, a MIC holds a portfolio of carefully-issued mortgages. The borrowers make their mortgage payments to the MIC, which in turn distributes the income to its investors. Unlike stocks, the MIC’s mortgages are secured by the underlying real estate, and are not affected by the stock market’s daily ups-and-downs. It’s a lot of upside, with limited downside.

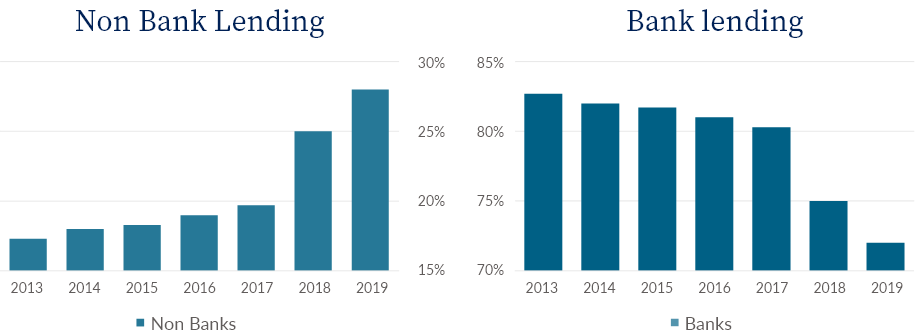

Mortgage Lending in Canada

Demand for non-bank, private mortgages has been increasing — especially since 2018 when banks were forced to impose tighter borrower qualifications.

3 Reasons to Invest

Higher Yields

With their fast approval process, flexible lending criteria and mortgage terms, MICs can charge higher interest rates. Investor returns may range from 6% to 10%, compared to less than 2% for a one-year Guaranteed Investment Certificate (GIC).

Diversification

As a fixed-income asset with no correlation to traditional asset classes (like stock markets), MICs can help offset the volatility of equities, while providing consistent income in today’s persistently low-yield environment. By investing alongside others, you will own shares in a much larger and more diversified real estate portfolio than you could hold on your own, with the benefit of a professional management team.

Tax Efficient Options

Your investment in Morex Capital can be held in your Registered Retirement Savings Plan (RRSP), your Registered Retirement Income Fund (RRIF), or your Tax-Free Saving Account (TFSA), providing the opportunity for tax-sheltered growth.

Efficient Investment Vehicles

MICs are exempt from tax under section 130.1 of the income tax act. 100% of the net earnings are distributed to investors as regular, quarterly distributions, and management expenses are kept low.

Risk

While most experts agree that investing in MICs is less risky/volatile than investing in the stock market, like any investment, MICs typically have exposure to some types of risk.

To get a clear picture of the risks associated with MICs, and what Morex Capital does to mitigate and manage those risks, please download our educational brochure on Mortgage Investing